Research

- Behavioral Finance and Social Finance

- Trading activities of retail investors

- Social interactions, communication, and (financial) decision making

- Narrative Economics

- Financial literacy and financial decision making

- Use cases and risks of generative AI in banking and finance

- ESG investments in Private Equity

- Arnold, M.; Pelster, M.; Subrahmanyam, M.G. (2022): 'Attention triggers and investors' risk-taking', Journal of Financial Economics 143, 846–875. (a Financial Times 50 Journal, Latest Thinking Video)

The paper investigates the impact of individual attention on investor risk-taking. We analyze a large sample of trading records from a brokerage service that allows its customers to trade contracts-for-differences (CFD), and sends standardized push messages on recent stock performance to its client investors. The advantage of this sample is that it allows us to isolate the "push" messages as individual attention triggers, which we can directly link to the same individuals' risk-taking. A particular advantage of CFD trading is that it allows investors to make use of leverage, which provides us a pure measure of investors' willingness to take risks that is independent of the decision to purchase a particular stock. Leverage is a major catalyst of speculative trading, as it increases the scope of extreme returns, and enables investors to take larger positions than what they can afford with their own capital. We show that investors execute attention-driven trades with higher leverage, compared to their other trades, as well as those of other investors who are not alerted by attention triggers.

Arnold, M.; Pelster, M.; Subrahmanyam, M.G. (2021): “Attention triggers and investors` risk-taking”, Journal of Financial Economics.

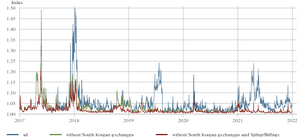

- Crépellière, T.; Pelster, M.; Zeisberger, S. (2023): 'Arbitrage in the Market for Cryptocurrencies', Journal of Financial Markets, 100817.

Arbitrage opportunities in markets for cryptocurrencies are well-documented. In this paper, we confirm that they exist; however, their magnitude decreased greatly from April 2018 onward. Analyzing various trading strategies, we show that it is barely possible to exploit existing price differences since then. We discuss and test several mechanisms that may be responsible for the increased market efficiency and find that informed trading is correlated with a reduction in arbitrage opportunities.

- Deng, J.; Yang, M.; Pelster, M.; Tan, Y. (2023): 'Social trading, communication, and networks', Information Systems Research 35, 1546-1564. (a Financial Times 50 Journal)

Social trading is an emerging market in the sharing economy, allowing inexperienced investors (followers) to automatically follow the trades of experts (leaders) in real time. We use a separable temporal exponential random graph model (STERGM) to analyze the formation and dissolution of links in a large social trading network. In contrast to traditional social networks, social trading networks are characterized by the rapid dissolution of links, thereby increasing the importance of studying network dissolution. We investigate how social communication, along with financial performance and demographics, affects dynamic network evolution and address the existing dependence in the leader-follower links. The determinants of link formation and dissolution are asymmetric. Different types of social communication, such as posts and comments, have different implications for link formation and dissolution. Our results show that financial performance and demographic characteristics also become important determinants of link formation. However, once a link is formed, followers focus mainly on financial performance, in addition to social communication, and not on demographic characteristics. Thus, our findings have important implications for both investors and social trading platforms.

- Koester, H.; Pelster, M. (2017): 'Financial penalties and bank performance', Journal of Banking and Finance 79, 57-73. (Latest Thinking Video)

The paper investigates the impact of financial penalties on the profitability and stock performance of banks. Using a unique dataset of 671 financial penalties imposed on 68 international listed banks over the period 2007 to 2014, we find a negative relation between financial penalties and pre-tax profitability but no relation with after-tax profitability. This result is explained by tax savings, as banks are allowed to deduct specific financial penalties from their taxable income. Moreover, our empirical analysis of the stock performance shows a positive relation between financial penalties and buy-and-hold returns, indicating that investors are pleased that cases are closed, that the banks successfully manage the consequences of misconduct, and that the financial penalties imposed are smaller than the accrued economic gains from the banks’ misconduct. This argument is supported by the positive abnormal returns accompanying on the announcement of a financial penalty.

- Mutschmann, M.; Hasso, T.; Pelster, M. (2022): 'Dark triad managerial personality and financial reporting manipulation', Journal of Business Ethics 181, 763-788. (a Financial Times 50 Journal)

The paper investigates the relationship between the dark triad personality traits (Machiavellianism, narcissism, and psychopathy) of managers and the practice of reporting manipulation using a primary survey of 837 professionals working in accounting and finance departments. We find that (a) managers who exhibit dark personality traits are associated with a higher prevalence of fraudulent accounting practices in their accounting and finance departments and (b) traditional risk management mechanisms are only partially effective in mitigating this effect. Internal audits are effective in curtailing the negative behavior of managers with dark triad traits only if these internal audits are outsourced and performed by independent external personnel but not if they are conducted by internal personnel. This suggests that managers with dark triad traits are able to manipulate other employees quite effectively. Consequently, having external personnel perform the auditing task provides a safeguard against such unethical practices and manipulation. This finding has strong practical implications, as it provides support for outsourcing internal audits rather than keeping them in-house.

- Ortmann, R.; Pelster, M.; Wengerek, S.T. (2020): 'COVID-19 and investor behavior', Finance Research Letters 37, 101717.

The paper studies the impact of the COVID-19 outbreak on investors' trading activities. We show that investors significantly increase their trading activities as the pandemic unfolds, both at the extensive and at the intensive margin. The number of investors who first open a brokerage-account increases, while at the same time established investors increase their average trading activities.

- Pelster, M. (2024): 'Leverage constraints and investors' choice of underlyings', Journal of Banking and Finance 162, 107150.

The paper investigates the impact of a 2018 intervention by the European Securities and Markets Authority (ESMA), which limits the amount of leverage that retail investors can take on their trading activities. While the intervention successfully reduced leverage-usage, investors shifted their trading activities to riskier assets in the process, consistent with the idea that leverage-constrained investors substitute leverage with riskier securities. Thus, the intervention was not as effective as the reduction in leverage suggests.

- Pelster, M.; Hofmann, A. (2018): 'About the fear of reputational loss: Social trading and the disposition effect', Journal of Banking and Finance 94, 75-88.

The paper studies the relationship between giving financial advice and the disposition effect on a social trading platform. Our empirical findings suggest that leader traders are more susceptible to the disposition effect than investors who are not being followed by any other trader. Using a difference-in-differences approach, we show that becoming a first-time financial advisor increases the disposition effect. This finding holds for investors who engage in foreign exchange trading and for investors who trade stocks and stock market indices. The increased behavioral bias may be explained by leaders feeling responsible to their followers, by a fear of losing followers when admitting a poor investment decision, or by an attempt by newly appointed leaders to manage their social image and self-image.

- Pelster, M.; Hofmann, A.; Klocke, N.; Warkulat, S. (2023): 'Managerial personality traits and selective hedging', Journal of Business Ethics 182, 261-286. (a Financial Times 50 Journal)

We study the relationship between risk managers' dark triad personality traits (Machiavellianism, narcissism, and psychopathy) and their selective hedging activities. Using a primary survey of 412 professional risk managers, we find that managers with dark personality traits are more likely to engage in selective hedging than those without. This effect is particularly pronounced for older, male, and less experienced risk managers. The effect is also stronger in smaller firms, less centralized risk management departments, and family-owned firms.

- Pelster, M.; Schertler, A. (2019): 'Pricing and issuance dependencies in structured financial product portfolios', Journal of Futures Markets 39, 342-365.

The paper studies pricing and issuance dependencies in a sample of structured financial products on the German performance index DAX. The study provides evidence that beyond conventional hedging, cross-pricing and cross-issuance of warrants and discount certificates contributes to risk reductions; consequently, these play an important role as risk management tools. Thus, our study emphasizes cross‐pricing from a perspective not previously considered in the literature.

- Pelster, M.; Val, J. (2023): 'Can ChatGPT assist in picking stocks?', Finance Research Letters, 104786.

This paper studies whether ChatGPT-4 with access to the internet is able to provide valuable investment advice and evaluate financial information in a timely manner. Using a live experiment, we find a positive correlation between ChatGPT-4 ratings and future earnings announcements and stock returns. We find evidence that ChatGPT-4 adjusts ratings in response to earnings surprises and news events information in a timely manner. An investment strategy based on "attractiveness ratings" by ChatGPT-4 yields positive returns.